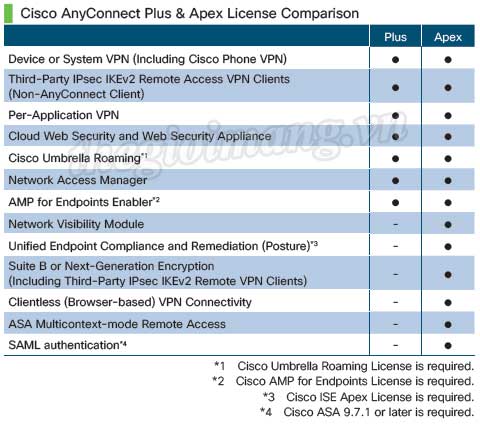

Features

L Ac Pls Lic 255

All AnyConnect Plus term licenses can be ordered using: L-AC-PLS-LIC= and Apex using L-AC-APX-LIC=. This ordering method should be used for all new orders and renewals as it provides flexible term duration (12-60 months), flexible start/end dates, and authorized user counts (25+). LIC Samridhi Plus Summary: LIC Samridhi Plus is a ULIP plan. LIC Samridhi Plus (Plan No.804) is a close ended plan which would be open for sale for a maximum period of 3 months. LIC Samridhi Plus Plan at Glance: Guaranteed Highest NAV of the first 100 months at Maturity Policy Term 10 years Lock in period 5 years Limited Premium Payment (5 years or single premium) Unlimited investment under.

Cached

25 users The Cisco AnyConnect Secure Mobility Client consistently raises the bar in remote access technology by making the experience easy for end users but with the security required by IT. The Cisco AnyConnect Secure Mobility Client provides a secure connectivity experience across a broad set of PC and mobile devices. L-AC-PLS-3YR-OPT: $0: Cisco AnyConnect 3-yr Plus Subscription License Option: 16: L-AC-PLS-3Y-S1: $14: Cisco AnyConnect Plus License, 3YR, 25-99 Users: 17: L-AC-PLS-3Y-S10: $1: Cisco AnyConnect Plus License, 3YR, 50K-99999 Users: 18: L-AC-PLS-3Y-S11: $1: Cisco AnyConnect Plus License, 3YR, 100K+ Users: 19: L-AC-PLS-3Y-S2: $12: Cisco AnyConnect.

AnyConnect 4 - Plus And Apex Licensing Explained | PeteNetLive

- Date of Withdrawal : 01.01.2014

- Unlike ordinary endowment insurance plans where the survival benefits are payable only at the end of the endowment period, this scheme provides for periodic payments of partial survival benefits as follows during the term of the policy, of course so long as the policy holder is alive.

In the case of a 20-year Money-Back Policy (Table 75), 20% of the sum assured becomes payable each after 5, 10, 15 years, and the balance of 40% plus the accrued bonus become payable at the 20th year.

For a Money-Back Policy of 25 years (Table 93), 15% of the sum assured becomes payable each after 5, 10, 15 and 20 years, and the balance 40% plus the accrued bonus become payable at the 25th year.

An important feature of this type of policies is that in the event of death at any time within the policy term, the death claim comprises full sum assured without deducting any of the survival benefit amounts, which have already been paid. Similarly, the bonus is also calculated on the full sum assured.

Comments are closed.